Tech

5starsstocks.com 3d printing stocks: A Comprehensive Guide to Investment Opportunities

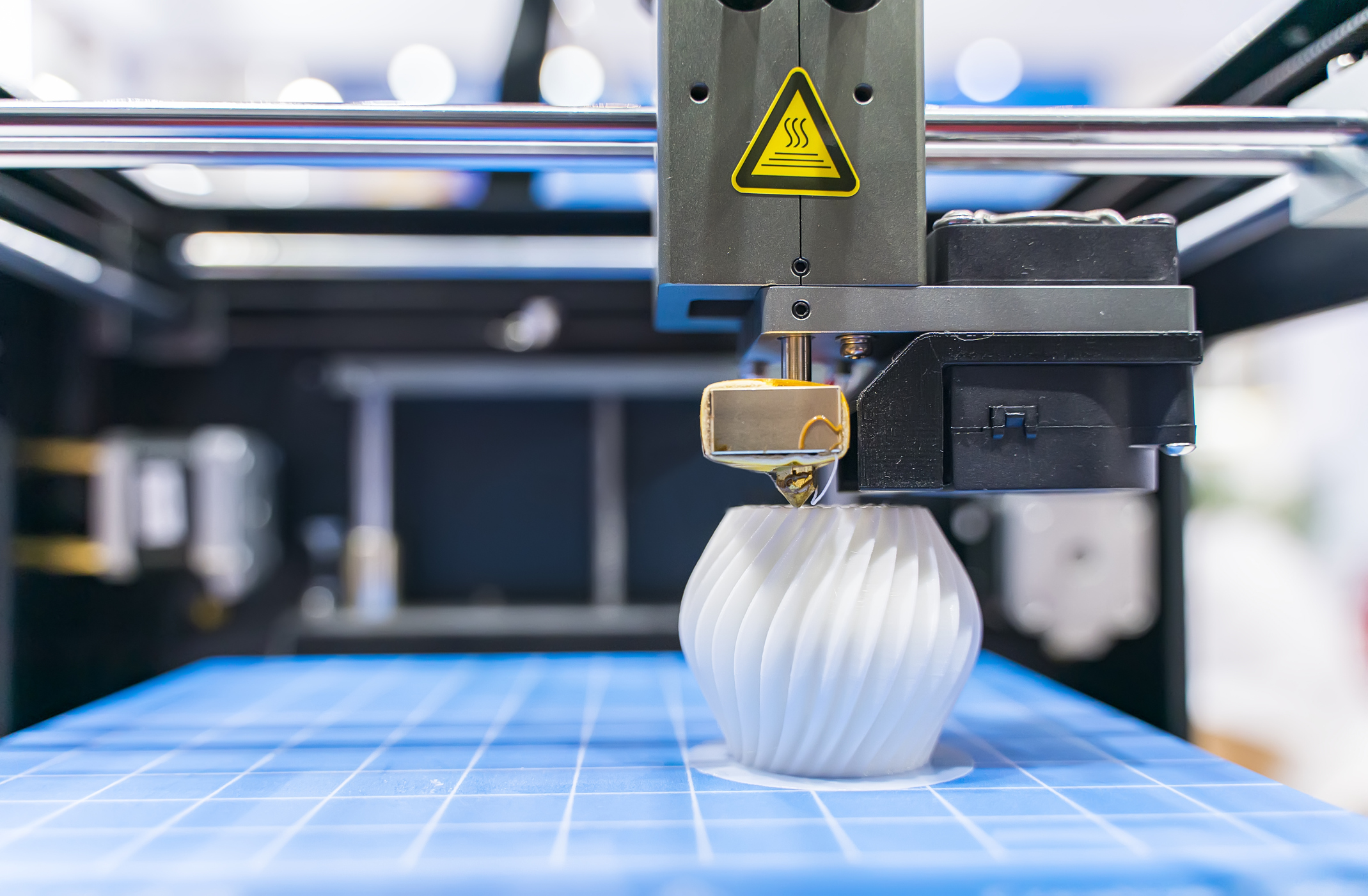

The 3D printing industry, also known as additive manufacturing, has experienced significant growth in recent years. This technology enables the creation of three-dimensional objects by adding material layer by layer, offering numerous applications across various sectors. Investors seeking to capitalize on this burgeoning market can explore several promising 3D printing stocks.

Understanding the 3D Printing Industry

3D printing has revolutionized traditional manufacturing processes by allowing for rapid prototyping, customization, and complex designs. Industries such as healthcare, aerospace, automotive, and consumer goods have adopted this technology to enhance product development and reduce production costs. The global 3D printing market is projected to grow at a compound annual growth rate (CAGR) of 23.3% through 2030, reaching a valuation of $88.28 billion.

Top 3D Printing Stocks to Consider

Investors interested in the 3D printing sector may consider the following companies, each offering unique contributions to the industry:

- Desktop Metal (DM): Specializing in metal 3D printing solutions, Desktop Metal has developed innovative technologies for various applications, including the dental market with its ScanUp initiative.

- Autodesk (ADSK): Known for its design software, Autodesk provides tools that facilitate 3D modeling and printing, serving professionals in architecture, engineering, and manufacturing.

- Altair Engineering (ALTR): Offering a comprehensive product development suite, Altair supports 3D printing processes with simulation and optimization tools, aiding in efficient design and manufacturing.

- Stratasys Ltd. (SSYS): As a leader in polymer 3D printing, Stratasys provides a range of printers and materials for industries such as aerospace, automotive, and healthcare.

- 3D Systems Corp. (DDD): Pioneering in 3D printing, 3D Systems offers solutions across hardware, software, and materials, catering to diverse sectors including healthcare and industrial applications.

Advantages of Investing in 3D Printing Stocks

Investing in 3D printing stocks presents several potential benefits:

- Customization and Design Flexibility: 3D printing allows for the production of complex and customized shapes that are challenging to achieve with traditional manufacturing methods. This flexibility opens avenues for innovation across various industries.

- Rapid Prototyping and Cost Savings: The technology enables quick and cost-effective creation of prototypes, streamlining product development and reducing time-to-market. This efficiency is particularly valuable for small businesses and individual consumers.

- Long-term Growth Potential: As 3D printing technology continues to evolve and find new applications, early investors in promising companies may experience substantial returns over time.

Considerations for Investors

While the 3D printing industry offers promising opportunities, investors should be mindful of the following:

- Market Volatility: The sector may experience fluctuations due to technological advancements, competition, and market adoption rates.

- Company Performance: Evaluating a company’s financial health, innovation pipeline, and market position is crucial before making investment decisions.

- Regulatory Environment: Compliance with industry standards and regulations can impact a company’s operations and profitability.

Conclusion

The 3D printing industry stands at the forefront of technological innovation, offering transformative solutions across multiple sectors. Investors seeking to capitalize on this growth may consider exploring stocks of companies that are leading advancements in additive manufacturing. However, thorough research and due diligence are essential to navigate the dynamic landscape of 3D printing investments

Tech

adsy.pw/hb3: Your Comprehensive Guide to Digital Marketing Excellence

In today’s rapidly evolving digital landscape, businesses and individuals alike are in constant pursuit of tools and platforms that can enhance their online presence. One such platform that has garnered significant attention is adsy.pw/hb3. This comprehensive guide delves into the multifaceted features, benefits, and applications of adsy.pw/hb3, illustrating how it can serve as a cornerstone in your digital marketing strategy.

Understanding adsy.pw/hb3

At its core, adsy.pw/hb3 is a dynamic digital marketing platform designed to bridge the gap between content creators, businesses, and publishers. It offers a streamlined approach to acquiring high-quality backlinks, optimizing content, and enhancing overall online visibility. By connecting users with verified publishers, adsy.pw/hb3 ensures that content reaches the right audience, thereby amplifying its impact.

Key Features of adsy.pw/hb3

-

Guest Posting Services: adsy.pw/hb3 facilitates connections between advertisers and niche authority websites, enabling the publication of content that resonates with targeted audiences. This not only boosts brand credibility but also drives organic traffic.

-

URL Shortening: The platform offers a URL shortening service, transforming lengthy web addresses into concise, shareable links. This feature is particularly beneficial for social media campaigns and content sharing, ensuring links are both aesthetically pleasing and functional.

-

Monetization Opportunities: Users can generate revenue through adsy.pw/hb3 by sharing shortened links. Each click on these links presents a brief advertisement, with earnings allocated to the user. This creates a passive income stream for content creators and marketers.

-

Comprehensive Analytics: adsy.pw/hb3 provides in-depth analytics and reporting tools, allowing users to track engagement metrics, assess the performance of their content, and refine their strategies accordingly. This data-driven approach ensures continuous improvement and optimization.

Benefits of Using adsy.pw/hb3

-

Enhanced SEO Performance: By securing high-quality, niche-relevant backlinks, users can significantly improve their search engine rankings. This leads to increased organic traffic and greater online visibility.

-

Time and Cost Efficiency: Traditional methods of acquiring backlinks and publishing guest posts can be time-consuming and costly. adsy.pw/hb3 streamlines this process, offering a cost-effective solution without compromising on quality.

-

User-Friendly Interface: The platform is designed with user experience in mind, ensuring that both novices and seasoned marketers can navigate its features with ease. This accessibility encourages widespread adoption and effective utilization.

How to Leverage adsy.pw/hb3 for Your Digital Strategy

-

Identify Your Objectives: Before diving into the platform, clearly outline your digital marketing goals. Whether it’s increasing website traffic, boosting brand awareness, or generating leads, having defined objectives will guide your strategy.

-

Engage with Relevant Publishers: Utilize adsy.pw/hb3’s network to connect with publishers that align with your niche. This ensures that your content reaches an audience that is genuinely interested in your offerings.

-

Create High-Quality Content: Focus on producing informative, engaging, and authoritative content. High-quality content not only appeals to readers but also encourages other websites to link back to your site, further enhancing your SEO efforts.

-

Monitor and Analyze Performance: Regularly review the analytics provided by adsy.pw/hb3 to assess the effectiveness of your campaigns. Use this data to make informed decisions and adjust your strategies as needed.

Common Misconceptions About adsy.pw/hb3

-

Overnight Success: While adsy.pw/hb3 provides powerful tools, it’s essential to understand that digital marketing success requires time and consistent effort. Patience and persistence are key.

-

One-Size-Fits-All: The platform offers a range of features, but it’s crucial to tailor your approach based on your specific goals and target audience. Customization enhances effectiveness.

Future Prospects of adsy.pw/hb3

As the digital landscape continues to evolve, platforms like adsy.pw/hb3 are poised to play an increasingly pivotal role in content marketing and SEO strategies. With a focus on quality, efficiency, and user empowerment, adsy.pw /hb3 is set to remain a valuable asset for those aiming to enhance their online presence.

Conclusion

Incorporating adsy.pw/hb3 into your digital marketing arsenal can yield substantial benefits, from improved SEO performance to efficient content distribution. By understanding its features and strategically leveraging its offerings, users can navigate the complexities of the digital world with confidence and success.

Tech

Vault opener? NYT Crossword Clue Explained

The New York Times (NYT) crossword puzzle is renowned for its clever wordplay and challenging clues. One such clue that often

perplexes solvers is “Vault opener?” This clue exemplifies the puzzle’s use of double meanings and requires a nuanced understanding to decipher.

Understanding the Clue

At first glance, “Vault opener?” might suggest something or someone that opens a secure storage, like a key or a safecracker. However, in the context of the NYT crossword, the clue often plays on alternative meanings. The word “vault” can refer to a gymnastic event where athletes use a pole to propel themselves over a bar, known as pole vaulting. Therefore, the “opener” of a vault in this sense is a “POLE.” This answer was confirmed in the NYT crossword on September 20, 2024.

The Art of Wordplay in Crosswords

Crossword constructors often employ wordplay to add layers of meaning to clues. In this instance, the clue “Vault opener?” uses a question mark to indicate a pun or a non-literal interpretation. Such clues require solvers to think beyond the obvious and consider multiple definitions of a word. The term “vault” can mean a secure room or a gymnastic event, and “opener” can refer to something that initiates or starts an action. Combining these meanings leads to the answer “POLE,” which is essential for pole vaulting.

Strategies for Deciphering Tricky Clues

To tackle such ambiguous clues, solvers can employ several strategies:

-

Consider Multiple Meanings: Words often have various definitions. Exploring different interpretations can lead to the correct answer.

-

Look for Indicators: Punctuation like question marks often signals wordplay or a non-literal clue.

-

Think About Word Associations: Consider phrases or terms commonly associated with the clue’s words.

-

Use Crossword Cross-References: Other clues in the puzzle can provide letters that help confirm potential answers.

The Evolution of Crossword Clues

Over time, crossword clues have become more inventive, incorporating puns, anagrams, and cultural references. The “Vault opener?” clue is a prime example of this evolution, challenging solvers to think creatively and appreciate the richness of the English language.

Conclusion

The “Vault opener?” clue in the NYT crossword is a testament to the puzzle’s intricate design and the cleverness of its constructors. By embracing the multifaceted nature of language and employing strategic thinking, solvers can unravel such enigmatic clues and enjoy the satisfaction of completing these beloved puzzles.

Tech

Atfboru: What You Need to Know About This Emerging Trend

Are you ready to dive into the vibrant world of ATFboru? This emerging trend is capturing the attention of fashion enthusiasts and trendsetters alike. With its unique blend of style, creativity, and cultural significance, ATFboru is more than just a buzzword—it’s a movement that reflects our ever-evolving societal landscape. Whether you’re already familiar with it or this is your first encounter, understanding what ATFboru represents could transform how you express yourself through fashion. Let’s explore this captivating phenomenon together!

History and Origin of Atfboru

Atfboru emerged from a blend of cultural influences and technological advancements. Its roots can be traced back to experimental fashion movements in the late 20th century, where artists began challenging traditional aesthetics.

In these early days, groups focused on sustainability and reimagining materials. They sought new ways to create clothing that not only looked good but also minimized environmental impact.

As digital technology progressed, designers started incorporating innovative techniques into their work. This fusion laid the groundwork for Atfboru’s distinctive style—characterized by bold patterns and unique silhouettes.

By the early 2020s, social media played a crucial role in popularizing Atfboru. Influencers showcased its versatility across various platforms, drawing attention from both consumers and large brands eager to embrace this emerging trend.

Today, Atfboru continues to evolve as it gains traction worldwide, inviting further exploration into its vibrant history.

How Does Atfboru Work?

Atfboru operates at the intersection of creativity and technology. It leverages advanced algorithms to analyze fashion trends, cultural influences, and consumer preferences.

Users can input their style preferences into the Atfboru platform. The system then generates personalized recommendations tailored to individual tastes.

This innovative approach enables designers and consumers alike to connect in real-time. Fashion enthusiasts receive insights that keep them ahead of trends while brands gain valuable feedback on their collections.

Additionally, Atfboru fosters community engagement through social features. Users share their unique looks and ideas, making it a collaborative space for inspiration.

By continuously learning from user interactions, Atfboru refines its suggestions over time. This dynamic evolution is what sets it apart in the crowded fashion landscape.

Benefits of Using Atfboru

Atfboru offers a fresh approach to self-expression. It encourages individuals to embrace their unique style without the constraints of traditional fashion norms.

One significant benefit is its accessibility. Atfboru caters to diverse body types and budgets, making it easier for everyone to participate. This inclusivity fosters a sense of community among enthusiasts.

Sustainability is another highlight. By promoting upcycling and creative reuse, Atfboru reduces waste in the fashion industry. Many creators focus on eco-friendly materials, supporting a healthier planet.

Additionally, using Atfboru can enhance creativity. It allows people to experiment with different styles, patterns, and colors that they may not have considered before.

Networking opportunities abound within this movement. Joining an Atfboru community can connect you with like-minded individuals who share your passion for innovative fashion choices.

Potential Risks and Concerns

As with any emerging trend, ATFboru presents certain risks and concerns that potential users should consider. One primary issue is its sustainability. The rapid adoption of this concept could lead to increased waste if not managed responsibly.

Additionally, the lack of regulation in the ATFboru space raises questions about quality and safety standards. Consumers may find it challenging to differentiate between genuine offerings and subpar imitations.

There’s also a social aspect to think about. As ATFboru gains traction, exclusivity may create division among communities. Those unable or unwilling to participate might feel alienated from conversations around fashion and identity.

There’s the risk of over-commercialization diluting what makes ATFboru unique in the first place. The essence could be lost amid an influx of brands vying for attention, making it essential to approach this trend thoughtfully.

How to Get Involved in Atfboru

Getting involved in ATFboru can be an exciting journey. Start by exploring online communities dedicated to the trend. Social media platforms are buzzing with posts and discussions related to ATFboru.

Consider attending workshops or local meetups where enthusiasts gather. These events provide a fantastic opportunity for networking and learning from experienced practitioners.

Don’t hesitate to experiment on your own. Create unique pieces using ATFboru techniques, and share your creations online. This not only hones your skills but also places you within the community spotlight.

Engage with influencers who advocate for ATFboru. Following their content can inspire new ideas and keep you updated on emerging trends.

Stay informed by reading blogs, watching tutorials, or subscribing to newsletters focused on ATFboru innovations. Embracing these resources will deepen your understanding and connection to this growing movement.

The Future of Atfboru

The future of ATFboru is bright and full of possibilities. As more people embrace this trend, we can expect an evolution in its applications across various sectors.

Innovation will play a crucial role. Designers are likely to experiment with new materials and techniques that push the boundaries of traditional fashion norms. This could lead to unique pieces that stand out in any wardrobe.

Furthermore, sustainability may become a key focus within the ATFboru movement. Eco-conscious consumers are rising, and brands might prioritize ethical practices in their production processes.

The digital landscape also holds promise for ATFboru’s growth. Social media platforms could serve as powerful tools for sharing ideas, styles, and inspirations related to this emerging trend.

As awareness continues to spread globally, collaborations between artists and designers may enrich the ATFboru experience even further. Such partnerships will foster creativity while keeping the essence intact.

The Origins of Atfboru

Atfboru has roots that trace back to various cultural movements. Emerging in the early 2020s, it reflects a blend of art and digital expression.

The term itself is derived from a fusion of influences. It draws inspiration from streetwear, avant-garde fashion, and online aesthetics.

Initially popularized by social media influencers, Atfboru quickly gained traction among younger audiences. Its unique style represents individuality and creativity.

As it evolved, Atfboru began incorporating sustainable practices. This aspect appealed to eco-conscious consumers who seek both style and responsibility.

From its inception, Atfboru has showcased a revolutionary approach to personal expression through clothing choices. The trend continues to evolve as more people embrace its ethos in their everyday lives.

Atfboru’s Impact in the Fashion Industry

Atfboru is making waves in the fashion world. Its unique blend of sustainability and innovation appeals to a new generation of consumers.

Fashion brands are increasingly adopting Atfboru principles, seeking eco-friendly materials and ethical production processes. This shift has led to more conscious choices in design.

The trend encourages creativity as designers experiment with unconventional fabrics and techniques. The result? Striking collections that resonate on both aesthetic and moral levels.

Moreover, Atfboru inspires collaboration between established labels and emerging talents. This fusion expands the industry’s horizons while promoting inclusivity.

As influencers advocate for sustainable practices, public interest grows rapidly. Shoppers are now prioritizing brands that align with their values, pushing the industry toward transparency.

In short, Atfboru is reshaping how we think about fashion today, driving it into a more responsible future without compromising on style or expression.

How to Incorporate Atfboru into Your Wardrobe

Incorporating ATFboru into your wardrobe can be a fun and creative process. Start by selecting statement pieces that resonate with your personal style. Look for unique patterns, textures, or colors that embody the essence of ATFboru.

Layering is key when integrating this trend. Pair an eye-catching ATFboru top with understated bottoms to let it shine without overwhelming your look. Accessorize thoughtfully; consider bold jewelry or footwear that complements but doesn’t compete.

Don’t shy away from mixing styles. Combine vintage finds with modern ATFboru elements for a distinctive flair. Play around with proportions—oversized tops can be balanced out with fitted trousers for a chic silhouette.

Stay true to yourself. The best way to wear any trend is by ensuring you feel comfortable and confident in what you choose to showcase each day.

Risks and Controversies Surrounding Atfboru

As with any emerging trend, ATFboru isn’t without its share of risks and controversies. Critics argue that the rapid adoption can lead to a superficial understanding of its principles, diluting its core message.

There’s also concern about sustainability. Some advocate for ethical practices in fashion but question whether ATFboru truly promotes these values or merely capitalizes on consumer trends.

Additionally, the exclusivity often associated with ATFboru raises eyebrows. Limited edition releases may foster a culture of elitism and accessibility issues among fans who wish to participate.

Social media plays a dual role here; while it helps spread awareness, it can also amplify negative sentiments quickly. Misrepresentation can occur as influencers might promote diluted versions of what ATFboru really stands for.

Ongoing debates around intellectual property rights create tension within creative communities. What constitutes originality when so many are inspired by one another?

Final Thoughts on Atfboru’s Potential

Atfboru is not just a fleeting trend; it embodies innovation and creativity. As it continues to gain traction, its implications extend far beyond mere aesthetics.

The fusion of technology and fashion opens up new avenues for self-expression. With Atfboru, individuals can redefine their personal style in ways previously unimaginable.

Moreover, the community surrounding this movement promotes inclusivity. It invites everyone to explore diverse styles without fear of judgment.

While challenges may arise, they are part of any evolving trend. The potential for growth and evolution remains promising.

As more people embrace Atfboru, we might witness an exciting transformation within the fashion landscape that encourages sustainability and originality. This shift could inspire future generations to think innovatively about what they wear and how they express themselves through clothing choices.

Conclusion

As ATFboru continues to shape the landscape of contemporary culture, its appeal grows among diverse audiences. This innovative trend is more than just a passing craze; it’s becoming a defining aspect of modern expression.

The evolution and adaptation of ATFboru signify the merging of tradition with innovation. Those who embrace it often find new ways to express their individuality.

While potential risks exist, they should not deter exploration. Engaging with ATFboru can lead to fresh perspectives and creative endeavors.

Staying informed about its developments allows individuals to make educated choices in both fashion and lifestyle. The journey into this emerging trend holds promise for anyone willing to dive in.

Curiosity will drive engagement further, allowing communities around this concept to flourish as they share experiences and insights on what makes ATFboru unique.

FAQs

What is ATFboru?

ATFboru refers to a contemporary trend that blends technology with fashion, creating unique opportunities for personal expression. It focuses on innovative designs that are not only aesthetically pleasing but also functional.

How did ATFboru originate?

The origins of ATFboru can be traced back to the intersection of digital art and streetwear culture. It gained traction as designers began experimenting with new materials and technologies, leading to the emergence of this distinctive style.

What are some benefits of adopting ATFboru in my wardrobe?

Adopting ATFboru styles can enhance your personal aesthetic while keeping you on-trend. The designs often emphasize sustainability and originality, making them both fashionable and environmentally friendly.

Are there any risks associated with ATFboru?

As with any emerging trend, potential risks include over-commercialization and loss of authenticity. Additionally, it may be challenging to find quality pieces due to a surge in demand.

How can I start incorporating ATFboru into my life?

Start small by adding one or two key pieces that embody the essence of ATFboru—think bold colors or innovative fabrics. You might also explore local pop-ups or online boutiques specializing in this trend.

Where do I see the future of ATFboru heading?

The future looks promising as more designers embrace technology-driven fashion concepts. As awareness grows, we may witness a broader acceptance among mainstream audiences.

Is there an impact from ATFboru within specific industries besides fashion?

Yes! Beyond clothing design, sectors such as advertising and marketing are experimenting with immersive experiences inspired by the dynamic nature of this trend.

Can anyone participate in the movement around ATFboru?

Absolutely! Whether you’re a designer or simply someone looking to express yourself through fashion choices, there’s room for everyone within this vibrant community.

-

Business6 months ago

Business6 months agoKennedy Funding Ripoff Report: Investigating the Allegations

-

Tech5 months ago

Tech5 months ago127.0.0.1:62893 The Gateway to Localhost Connectivity

-

Review9 months ago

Absolver – Review (Tech Raptor)

-

Review9 months ago

Review9 months agoGod Of War: Ascension – A.D.P. Review (+Video Review)

-

Crypto8 months ago

Crypto8 months agoBe1crypto: From Startup to Leading Crypto News Source

-

Health7 months ago

Health7 months ago8.4 How Health Insurance Works Student Activity Packet Answer Key: A Comprehensive Guide

-

Entertainment7 months ago

Entertainment7 months agoAlameda Seaplane Ferry: A Comprehensive Guide to San Francisco Bay’s Newest Commute Option

-

Entertainment7 months ago

Entertainment7 months ago123 Movies: Exploring Its Rise, Impact, and Legal Implications